Digital Finance Revolution How Sri Lanka’s Women and Youth Are Breaking the Poverty Cycle

By Ernest Dube, Banan Massoud Elsayed, John Mark Udalang Ojwang

A pioneering digital financial inclusion programme is transforming lives across rural Sri Lanka, offering a blueprint for tackling unemployment in developing economies worldwide

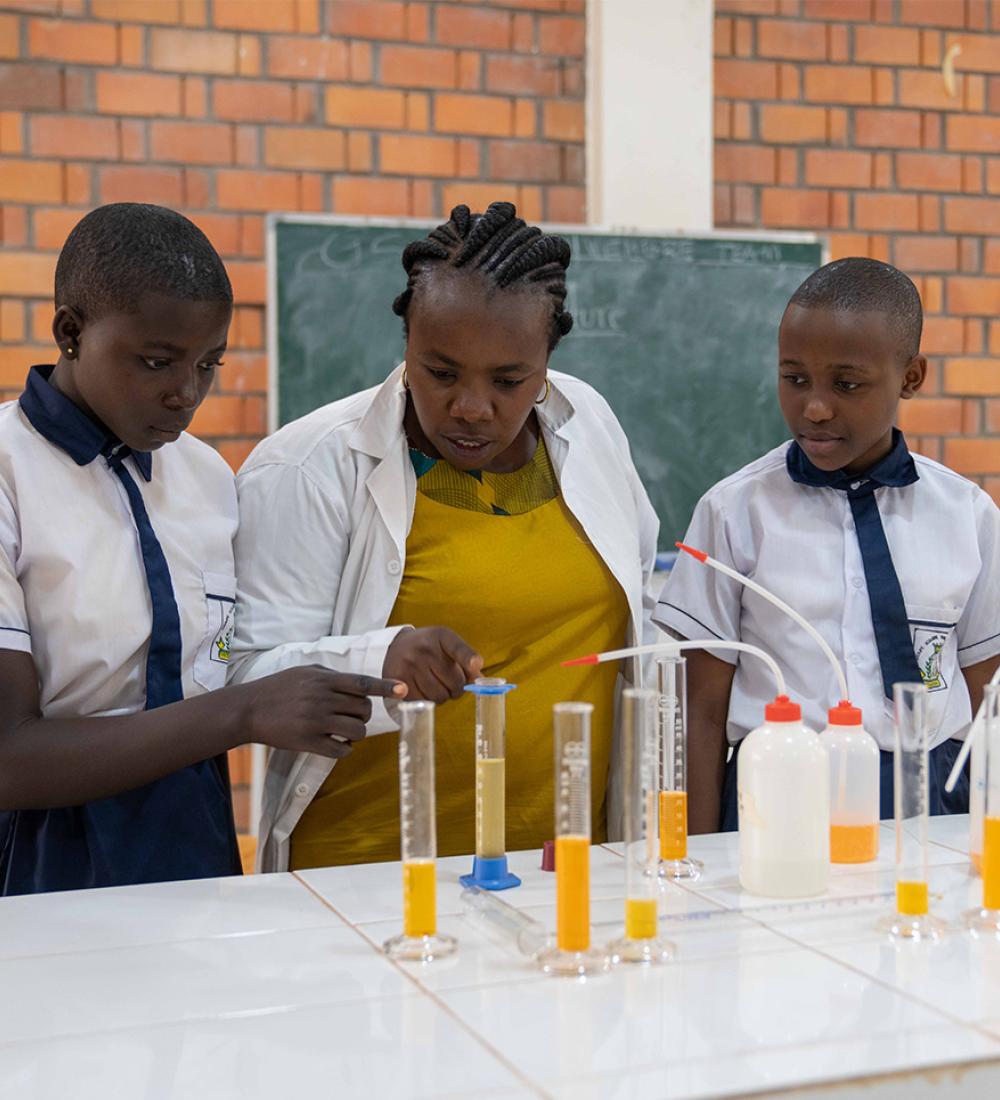

Sri Lanka, in a country where one in five young people struggles to find work, a digital finance initiative is gradually rewriting the economic futures of thousands of youth entrepreneurs, especially women.

As the world marks International Day of Rural Women on October 15, their stories highlight how access to technology and credit is empowering a new generation of rural women to lead change from the ground up. The Digital Financial Inclusion for Youth Economic Empowerment project has reached over 34,000 beneficiaries since September 2022, demonstrating that when technology meets accessible credit, transformation happens fast.

The Challenge

Sri Lanka has been facing a youth unemployment crisis, with 20.6% of people aged 15-24 without work as of early 2024. For young women, the situation is worse at 29.5%. This mirrors a broader global crisis: 2.5 billion adults worldwide don’t use formal financial services, and 75% of poor people are unbanked because of costs, travel distances and burdensome requirements.

With 77.4% of Sri Lanka’s population living in rural areas, traditional banking infrastructure often doesn’t reach those who need it most. Research shows the extent of outreach of private operators including NGOs and commercial banks in rural areas remains rather limited. The Pasio platform, implemented through Sejaya Microfinance with support from Education Above All Foundation’s Silatech programme and Gojo Inc., has been working in South and Southeast Asia to change that equation.

A Complete Ecosystem

The numbers tell a powerful story. The platform achieved a 90% active usage rate among enrolled users, with 75% utilizing instant loan features. Beneficiaries reported revenue growth ranging from 60% to 167% across different business sectors. One spice retailer saw daily profits jump from Rs. 3,000 to Rs. 8,000. A bag manufacturer expanded production from 15-20 bags quarterly to 40-50 bags, creating jobs for others.

What makes this different? Integration. Participants receive loans plus access to a WhatsApp-based community platform for marketing products, financial literacy training through a Training-of-Trainers model, flexible repayment terms, and real-time loan management through a mobile app.

“Initially, I was only selling my products in my shop, but through the platform, I managed to increase my market reach,” explained a textile entrepreneur from Welimada. “What started as 5 pieces per month has grown to twelve pieces monthly.”

Jobs, Housing, Education

While direct job creation averaged 1-3 positions per successful enterprise, the economic multiplier effects proved significant. Manufacturing businesses created 2-3 permanent jobs, agricultural enterprises generated 4-5 seasonal positions, and retail operations added 1-2 temporary workers.

The impact extended beyond business. Sixty percent of participants acquired significant assets, from vehicles to machinery. Forty percent invested in home construction or improvements. Half of beneficiaries increased investment in their children’s education. Two-thirds established regular savings habits, a fundamental shift in communities where day-to-day survival was previously the norm.

“I am proud of being independent, not reliant on anyone,” said Anjani Basnayaka, 25, whose weaving business now generates 45,000 rupees monthly, a fifteen-fold increase.

Global Blueprint

The model addresses universal barriers. Average loan sizes of 40,000-100,000 rupees (approximately $137-$344) are significantly smaller than traditional bank requirements. The approval process takes just 7 days compared to weeks or months with conventional banks. There’s no physical collateral requirement. Instead, the platform uses alternative creditworthiness assessment and social validation through community networks.

In South and South-East Asia, approximately half of all business exits are due to either lack of capital or limited profitability. Youth-led enterprises find it particularly difficult to obtain capital. Research shows that digital technology has the potential to enable youth entrepreneurship and lower barriers, with access to the internet, education, and owner experience instrumental in driving adoption.

Challenges Ahead

The project faces obstacles. Limited smartphone ownership among lower-income beneficiaries presents a critical barrier. Poor network coverage in remote areas hampers real-time transactions. Some older beneficiaries struggled with app navigation. Perhaps most significantly, the platform could integrate employment tracking tools to gather real-time data on job creation, strengthening evidence of community-level impact.

Beyond Sri Lanka

The lessons from Sri Lanka hold particular relevance for Sub-Saharan Africa and South Asia, where similar challenges of youth unemployment, rural financial exclusion, and limited formal banking infrastructure persist. The model demonstrates that digital platforms can leapfrog traditional infrastructure constraints, but success requires more than technology. It demands comprehensive training, community engagement, affordable loan products, and sustained field support.

In an era where youth unemployment threatens economic stability across developing nations, the Pasio platform offers something increasingly rare: a scalable solution backed by evidence. From rural Sri Lankan villages to similar communities across Asia and Africa, the question isn’t whether digital financial inclusion works. The question is how quickly it can scale.

Disclaimer: The author first published this story in October 2025 on the Daily Mirror UK website. Click here to read the original post.